eTIMS is a software solution for tax invoicing and can be accessed through various electronic devices including computers, laptops, tablets, smartphones and PDAs.

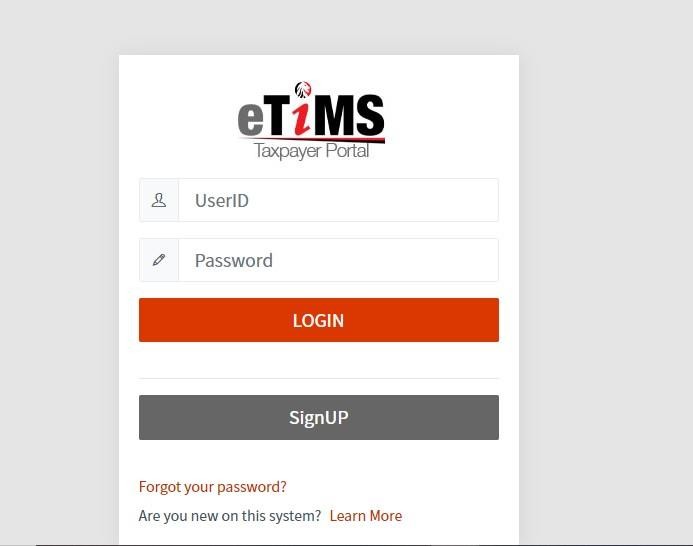

eTims Taxpayer Portal

https://etims.kra.go.ke/basic/login/indexLogin

PROCEDURE FOR eTIMS APPLICATION

Step 1: To access the eTIMS portal search for the url

https://etims.kra.go.ke/basic/login/index and click on the Sign-Up button.

How To Check NHIF Status

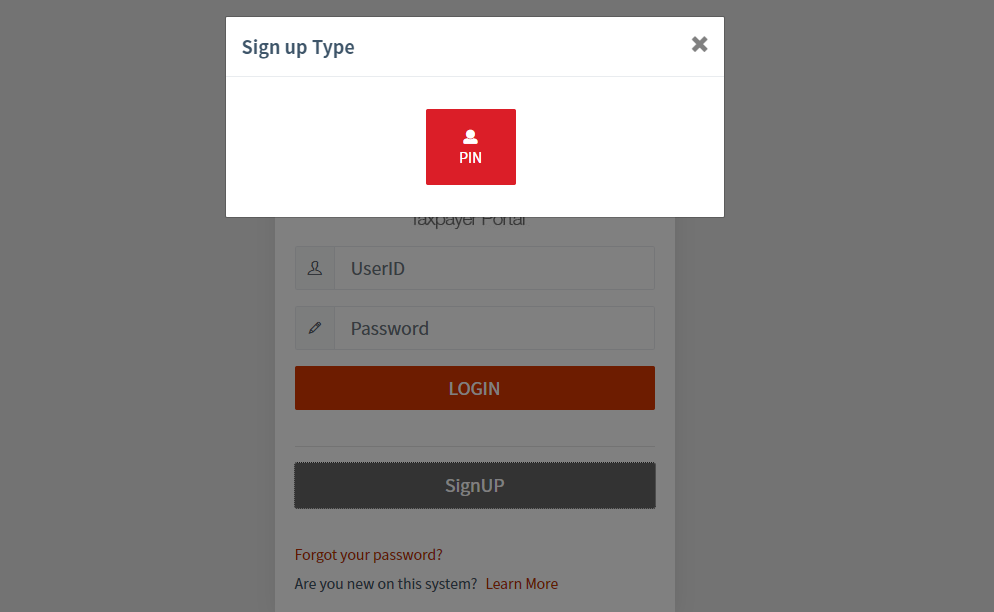

Step 2: Click on the PIN button

![]()

ISO 9001:2015 CERTIFIED

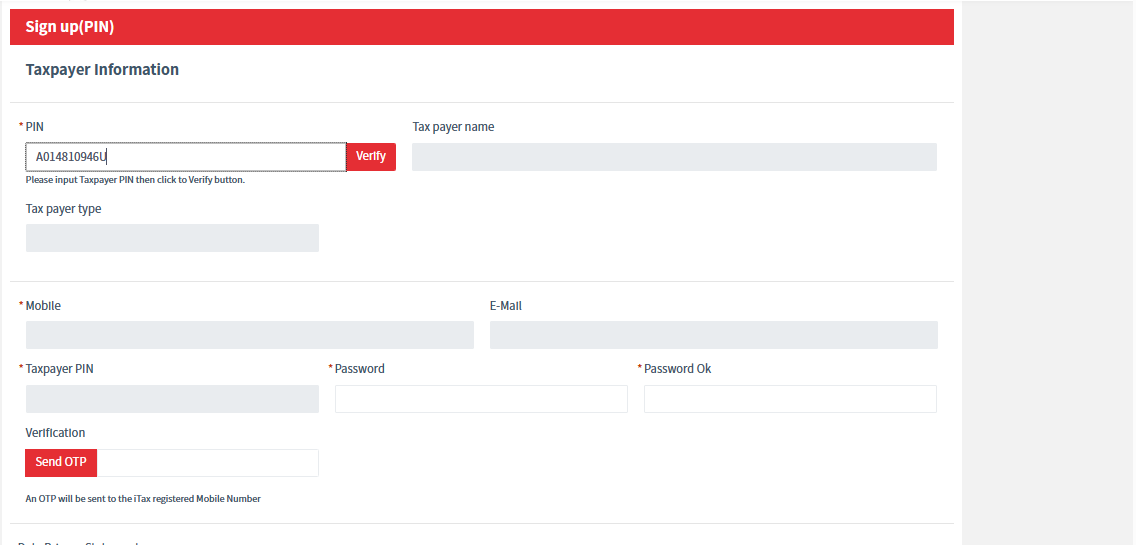

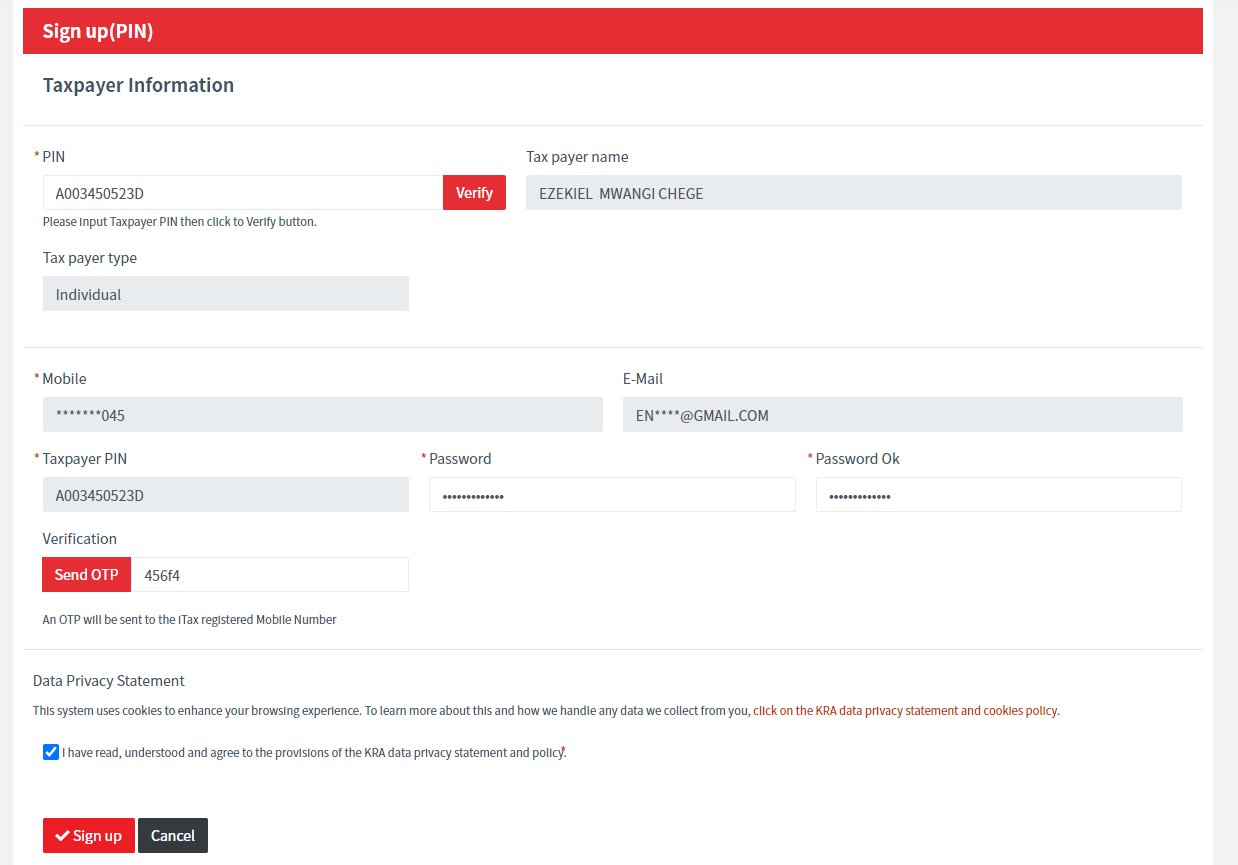

Step 3: Enter your PIN and click the Verify button

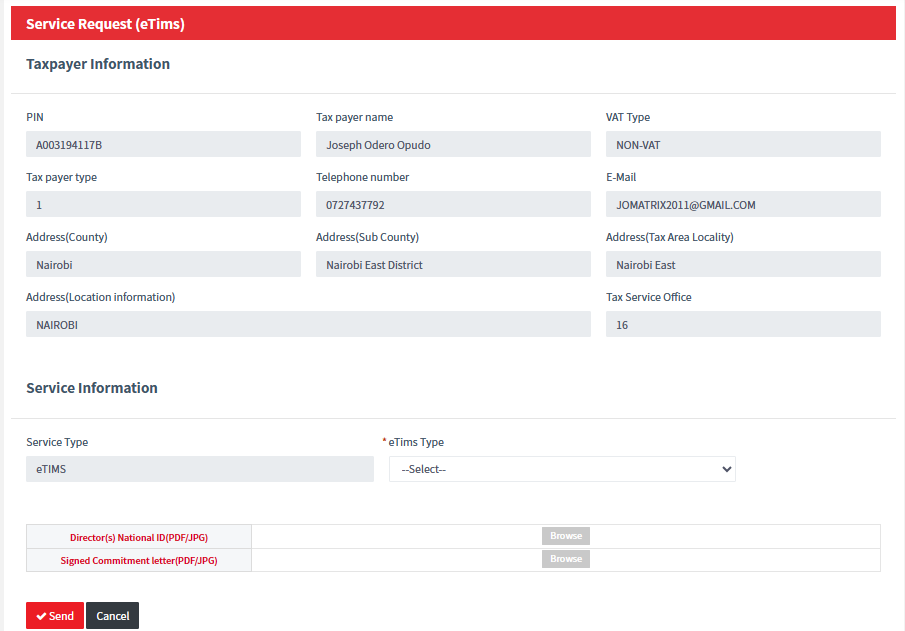

Step 4: Taxpayer’s information populates.

The taxpayer will then create a password and confirm the same then click the Send OTP button to receive a security code on their phone number. They will then enter the security code and check the box to confirm that they have gone through the Data Privacy Statement. Finally, they click on the Sign Up button.

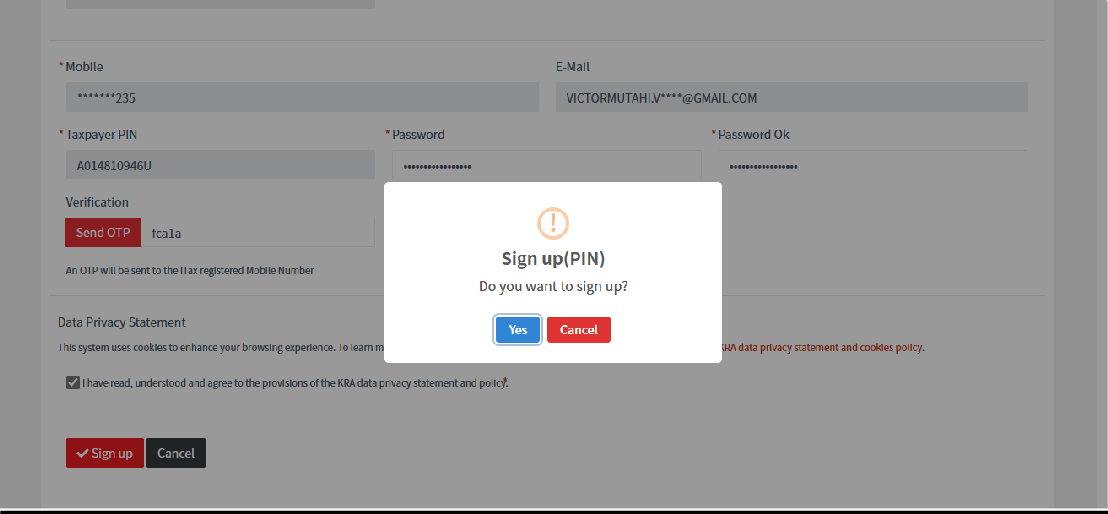

Step 5: A sign up confirmation message populates. Click yes to complete the sign up.

End of Sign-up process

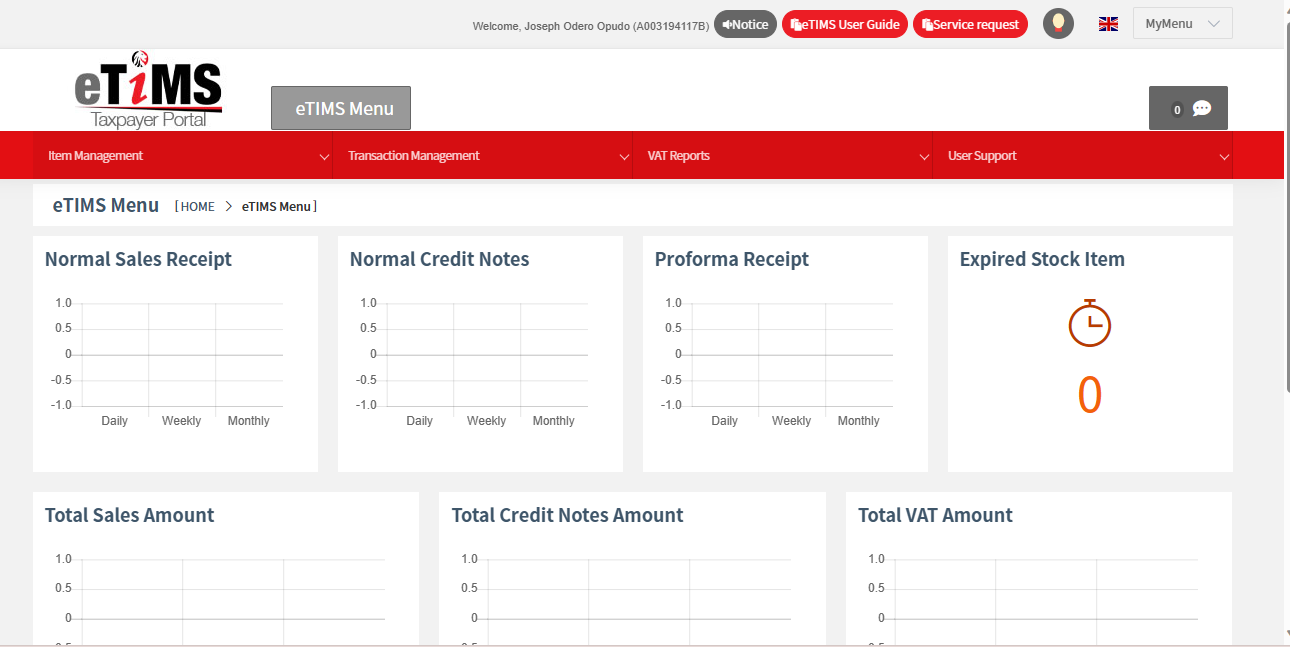

Step 6: Taxpayer logs on to the eTIMS taxpayer portal using their UserID (KRA PIN) and password.

![]()

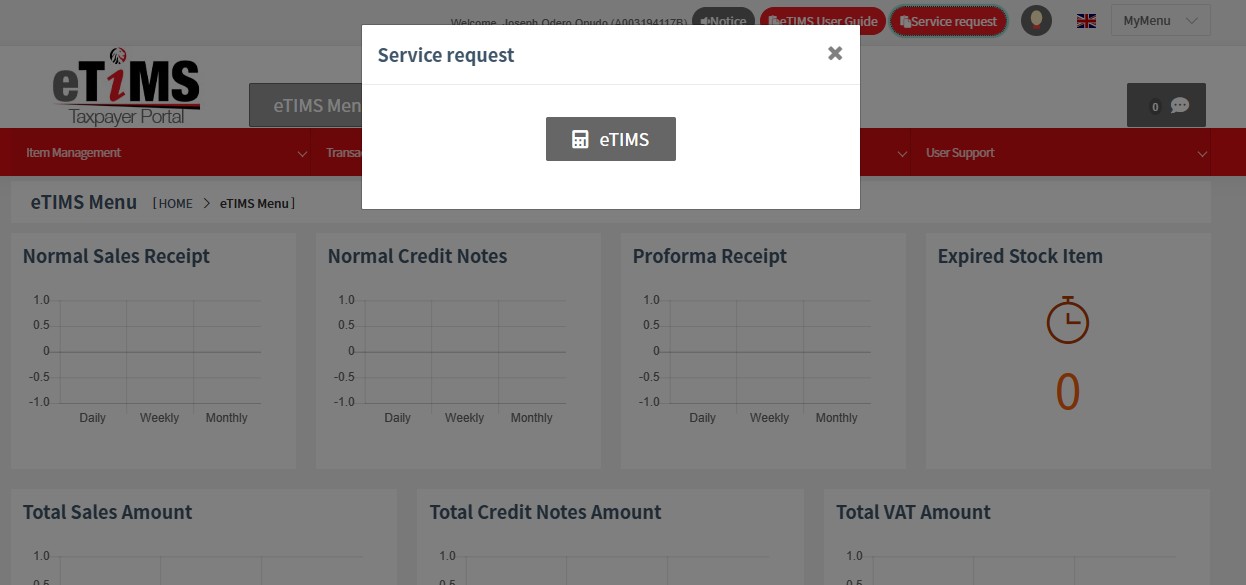

Step 7: Click the Service request button on the top right corner.

Step 8: Click the ETIMS button.

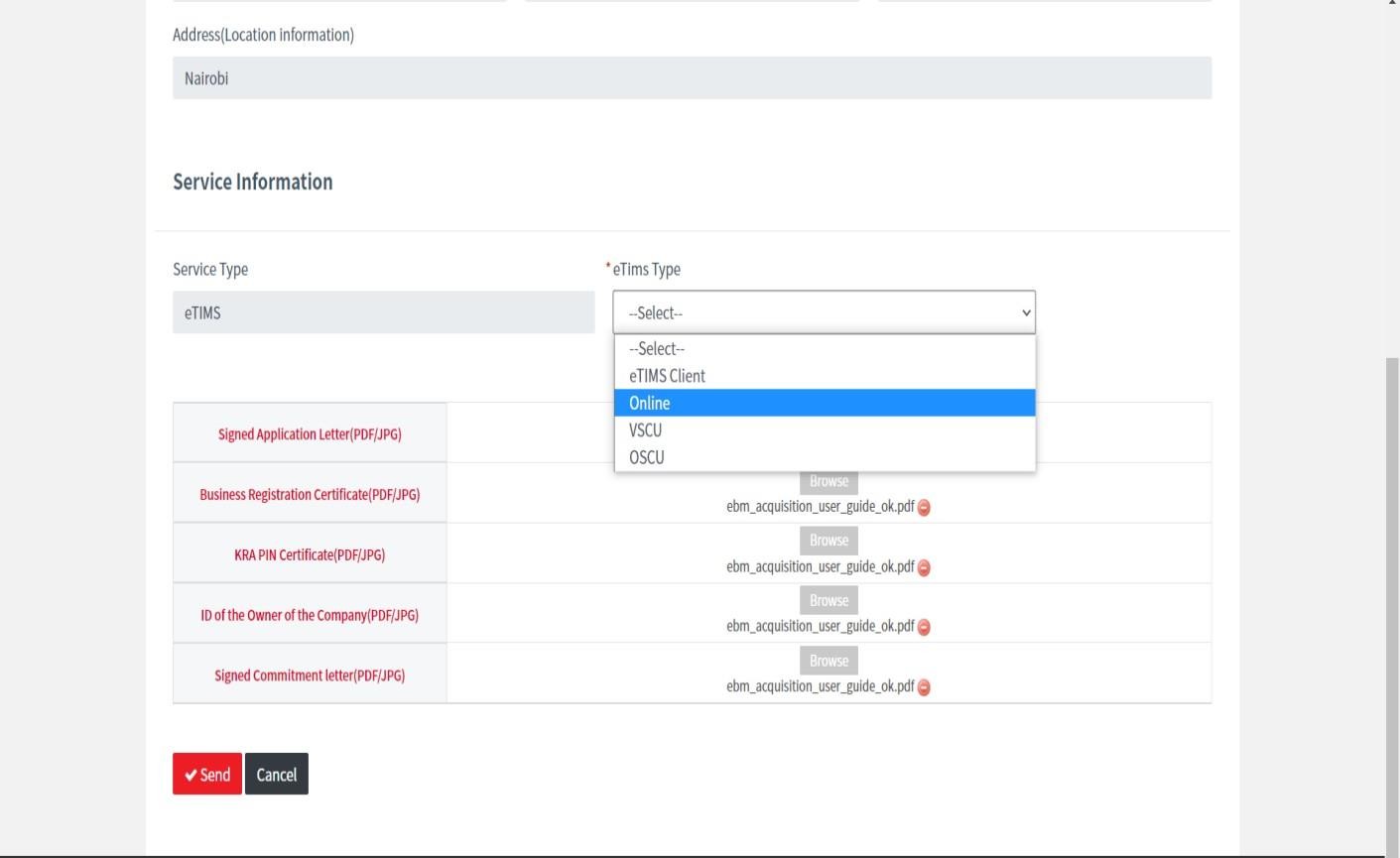

Step 9: The taxpayer’s data should be displayed as follows. Click the drop- down arrow under the eTIMS type and select eTIMS solution that is suitable for your business.

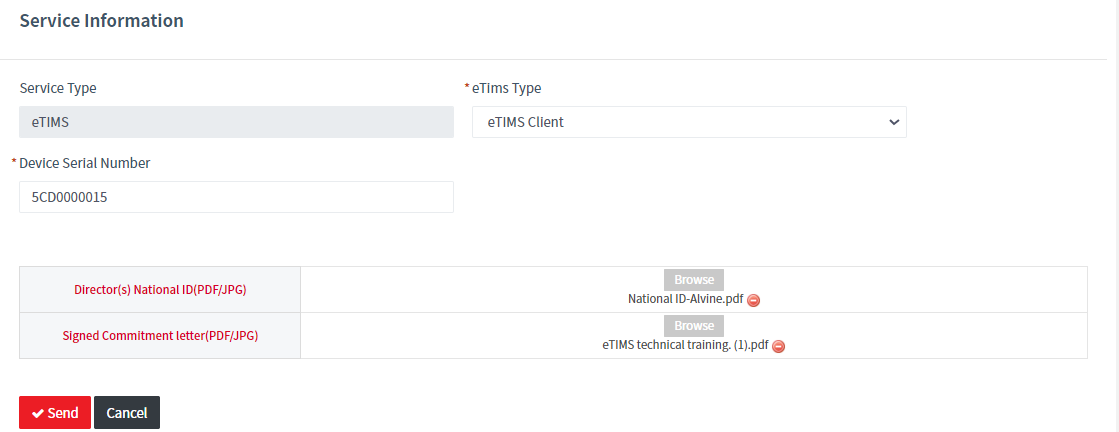

Step 10: Attach the required documents and click the Send button.

NB: If you app for eTIMS Client you will be required to provide the serial number of the device you intend to download the software on.

e