The popularity of money market funds in Kenya has been on the rise as people look for better saving options with high returns, low risks, and liquidity. To cater to the increasing demand, Kenyan banks have started offering MMFs to compete with existing current and savings accounts. However, it’s crucial to determine the best money market fund and understand their annual returns.

15 Top Money Market Funds in Kenya-2024

| FUND NAME | Nominal Performance % | MIN. INVESTMENT | MIN. TOP-UP |

| Etica Money Market Fund | 17.30 | Ksh. 100 | Ksh. 100 |

| Nabo Africa Money Market Fund | 16.20 | Ksh. 5,000 | Ksh. 1,000 |

| CIC Money Market Fund | 15.72 | Ksh. 5,000 | Ksh. 1,000 |

| GenAfrica Money Market Fund | 15.68 | Ksh. 1,000 | Ksh. 1,000 |

| Enwealth Money Market Fund | 15.30 | Ksh. 5,000 | Ksh. 1,000 |

| Sanlam Money Market Fund | 15.25 | Ksh. 2,500 | Ksh. 1,000 |

| Kuza’s Money Market Fund (MMF) | 14..95 | Ksh. 5,000 | Ksh. 1,000 |

| KCB Money Market Fund: | 14.83 | Ksh. 5,000 | Ksh. 500 |

| GenCap Hela Imara MM Fund | 14.61 | Ksh. 1000 | Ksh. 500 |

| Madison Money Market Fund | 14.54 | Ksh. 5,000 | Ksh. 1,000 |

| Britam Money Market Fund: | 14.32 | Ksh. 5,000 | Ksh. 1,000 |

| Old Mutual Money Market Fund | 14.22 | Ksh. 5,000 | Ksh. 1,000 |

| Equity Bank Money Market Fund: | 13.00 | Ksh. 1,000 | Ksh. 500 |

| Orient Kasha (MMF) | 12.88 | Ksh. 5,000 | Ksh. 1,000 |

| ICEA Lion Money Market Fund (MMF) | 12.78 | Ksh. 500 | No limit |

How to withdraw money from PayPal to Mpesa

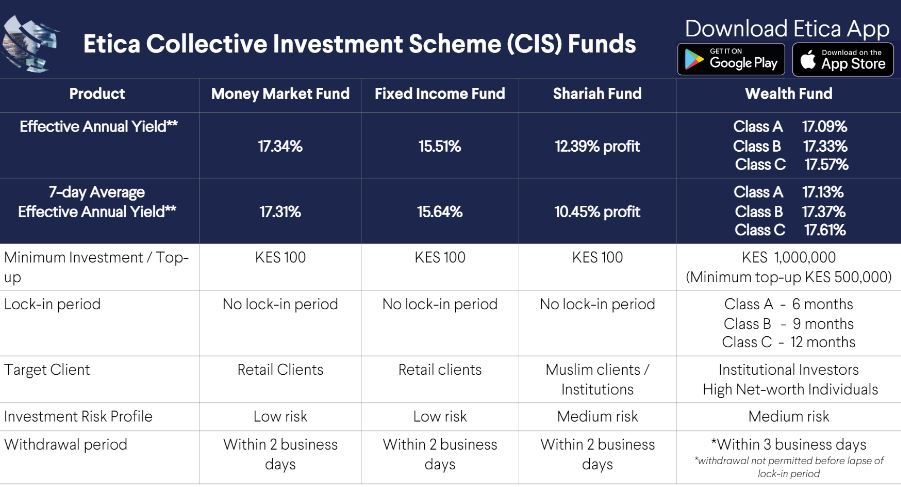

1. Etica Money Market Fund

Outperforming the competition with the highest daily average yield is the Etica Money Market Fund, which boasted an average daily yield 17.30%.

Below table shows detailed breakdown of Etica MMF

2.Nabo Africa Money Market Fund

Minimum Initial Investment: KES 5,000

Minimum Top-Up: KES 1,000

Registration: Accessible through online and mobile app

Performance: Competitive returns at 16.20% nominal, with a reliable track record

Convenience: Easy access through online and mobile platforms

Automation: Automatic sweeps and reinvestment options available

Ease of Use: Transparent fees and accessible customer support.

3.CIC Money Market Fund

CIC Money Market Fund ranks third with an interest rate of 15.72%. It was launched in June 2011 and is one of the most established MMFs in Kenya. With over 41% of the total assets under management in the Kenyan market, it holds the largest market share. The minimum initial deposit required to open a CIC Money Market account is Kshs 5,000.

4.GenAfrica Money Market Fund

Accessible minimum investment of Sh1,000. Steady returns at around 15.68% nominal with a reliable track record. Streamlined online transactions with automatic sweeps and reinvestments. A simple yet efficient mobile app for basic fund management.

5.Enwealth Money Market Fund

Minimum initial investment is Ksh 5,000, while the minimum top-up is Ksh 1,000. You can register online or through the mobile app. The platform offers competitive returns of approximately 15.30% nominal with a strong track record. It is also user-friendly, with investment goal setting tools available on the mobile app. Automatic sweeps from linked bank accounts and flexible reinvestment options are available. The information provided is clear and customer support is responsive.

6.Sanlam Money Market Fund

Minimum Initial Investment: KES 2,500 Minimum Top-Up: KES 1,000 Registration: Accessible through online or mobile app platforms Performance: Offers competitive returns of around 15.25% nominal, with a strong track record Convenience: User-friendly interface with goal-based investment features Automation: Automatic sweeps and reinvestment options, with daily interest calculations Ease of Use: Transparent fees and easily accessible customer support

7.Kuza’s Money Market Fund (MMF)

Kuza MMF currently offers a yield of approximately 14.95% nominal, which is competitive within the Kenyan market.

Minimum top-up is KES 1,000 with a 2-week lock-in period. Fund manager is Kuza Asset Management. Benchmark is GOK 91-day T-Bill. Annual management fee is 2.00%, and distribution frequency is monthly. The trustee is Co-operative Bank of Kenya, and the custodian is Kenya Commercial Bank Limited.

8.KCB Money Market Fund

Minimum initial investment is Sh5,000 with a minimum top-up of Sh500. Register through an online portal or mobile app. Consistent returns around 14.83% nominal, backed by a reputable bank. Access a user-friendly mobile app and a wide branch network for deposits/withdrawals.

9.GenCap Hela Imara MM Fund

Accessible minimum investment of Sh1,000, with online and mobile app access. Reliable track record with steady returns of around 15.68% nominal. Offers streamlined online transactions, automatic sweeps, and reinvestments. Simple yet efficient mobile app for basic fund management.

10.Madison Money Market Fund

Invest easily with a minimum of Sh5,000 and online or mobile access. Get reliable returns of around 14.54% nominal with a consistent track record. Transactions are automated, and you’ll receive monthly interest payments. Use the user-friendly mobile app with basic features. Fees are transparent, and customer support is responsive.

11.Britam Money Market Fund:

Initial investment amount of Kes 1000, minimum top-up amount 1000. Annual management fee 1.5%. Withdrawals processed within 2 working days. Reliable returns around 14.32% nominal with strong brand reputation.

12.Old Mutual Money Market Fund

The Old Mutual Money Market Fund allows for an initial investment of at least Sh5,000 and a top-up of at least Sh1,000. Registration can be completed online or through the mobile app. The fund has a reliable return rate of around 14.22% nominal and is backed by an established brand reputation. The platform is secure and user-friendly, with investment tracking tools available. Basic transaction automation is provided, along with monthly interest distribution.

13.Equity Bank Money Market Fund

Equity Bank offers a Money Market Fund that requires a minimum investment of Sh1,000, making it a mid-range entry point for those looking for a focused option. You can also top up your investment with a minimum of Sh500, giving you flexibility for regular contributions. The yield for this fund is around 13.00% nominal, making it one of the highest yielding money market funds in Kenya. The fund primarily invests in government securities and other high-quality, short-term debt instruments. You can conveniently invest and manage your funds through Equity Bank’s extensive branch network, mobile app, and online platform.

14.Orient Kasha (MMF)

Invest at least Sh5,000 and top-up Sh1,000 for competitive returns of around 12.88% nominal yield, one of the top performers in Kenya.

15.ICEA Lion Money Market Fund (MMF)

Invest from Sh500, top-up anytime, and get a competitive 12.78% nominal yield. Choose from online, mobile app, and agent network for easy investing and withdrawals. Access your funds anytime without penalties. Your investments are secure with a reputable custodian bank.

[…] 15 Best Money Market Funds in Kenya. […]

[…] 15 Best Money Market Funds in Kenya. […]

[…] 15 Best Money Market Funds in Kenya. […]

[…] 15 Best Money Market Funds in Kenya. […]

[…] 15 Best Money Market Funds in Kenya. […]